Technical Due Diligence

Technical Due Diligence

Due diligence for a proposed acquisition of a company headquartered in Santa Barbara, California.

Due diligence for a proposed acquisition of a company headquartered in Santa Barbara, California.

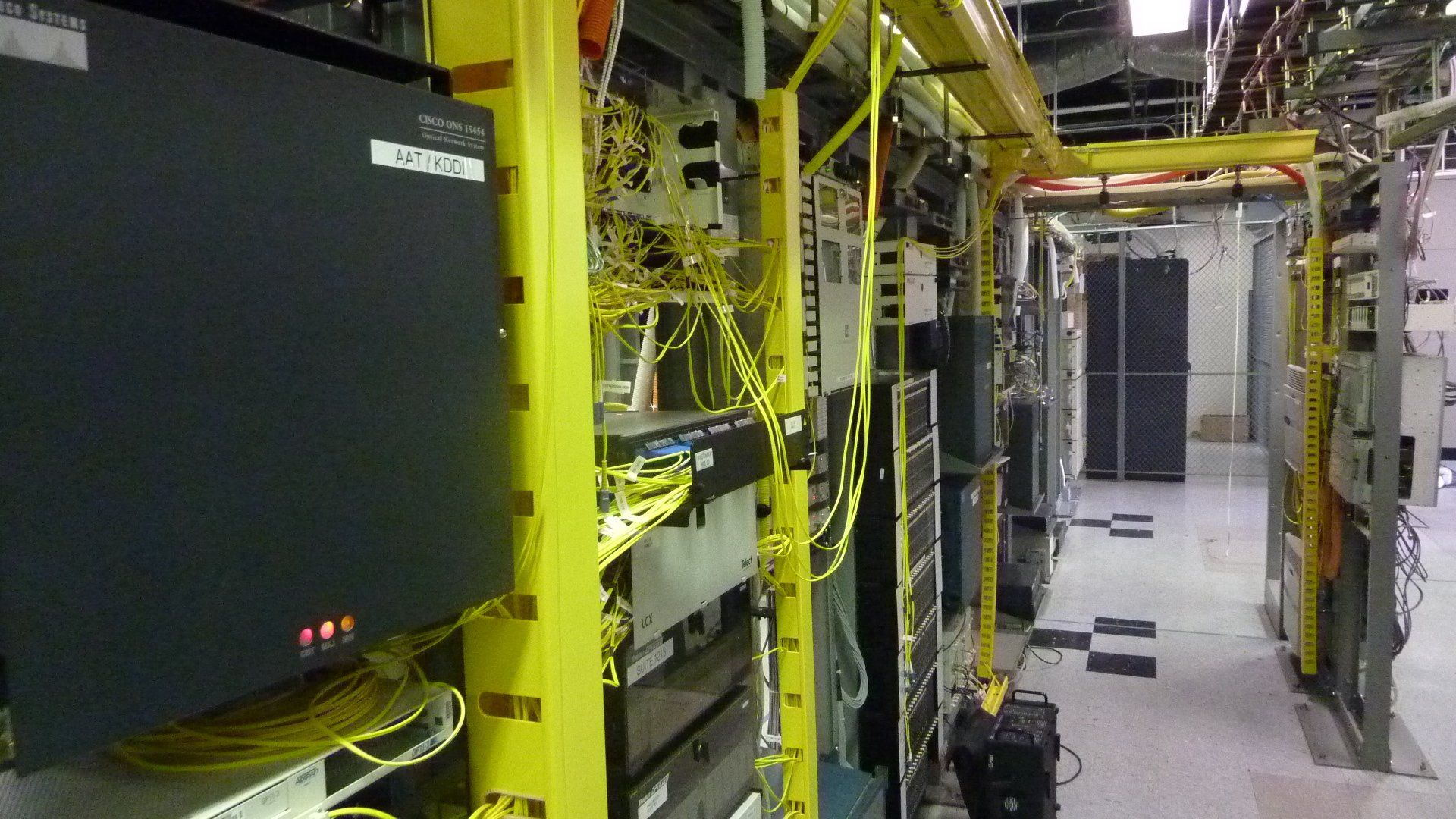

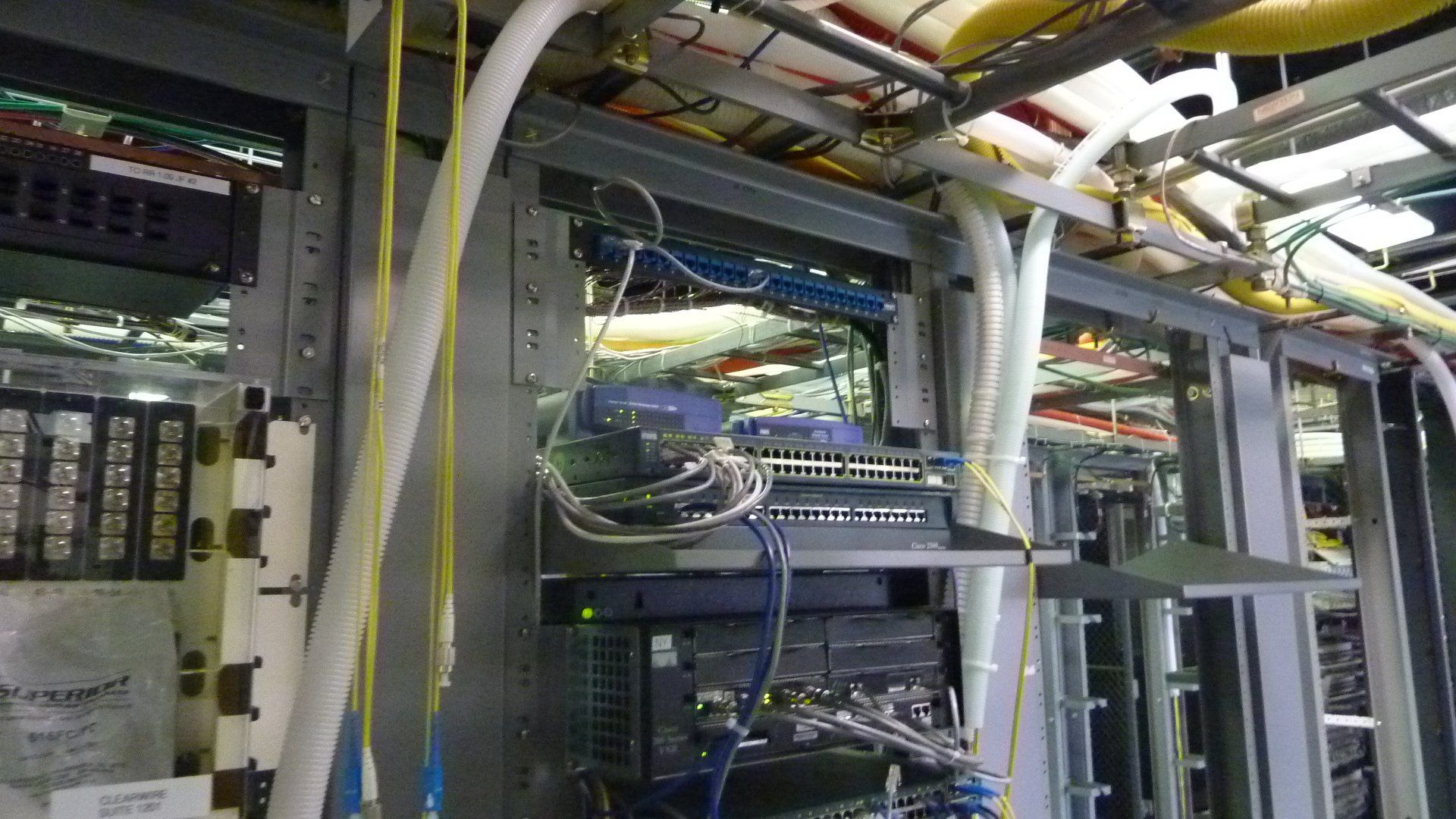

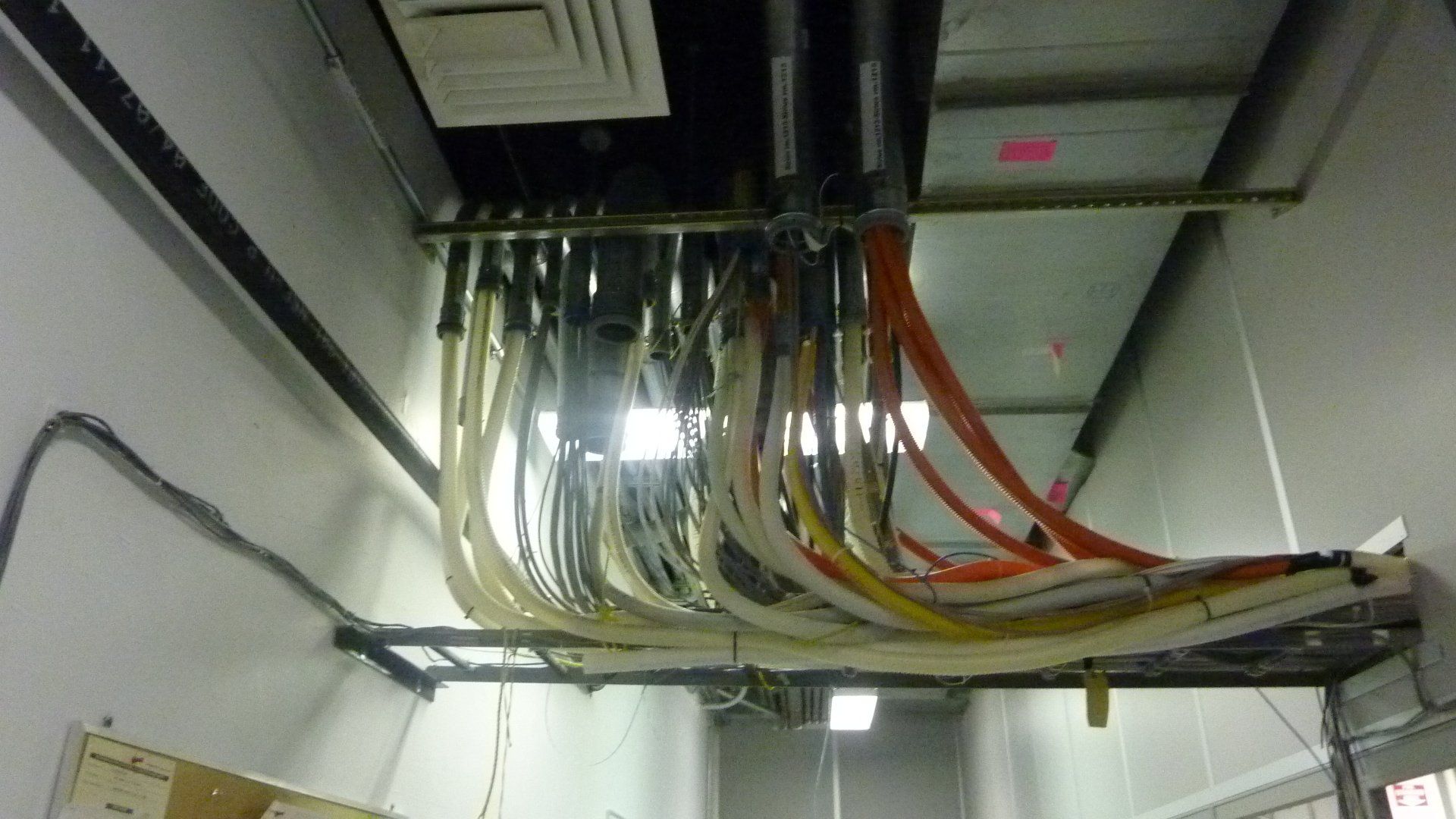

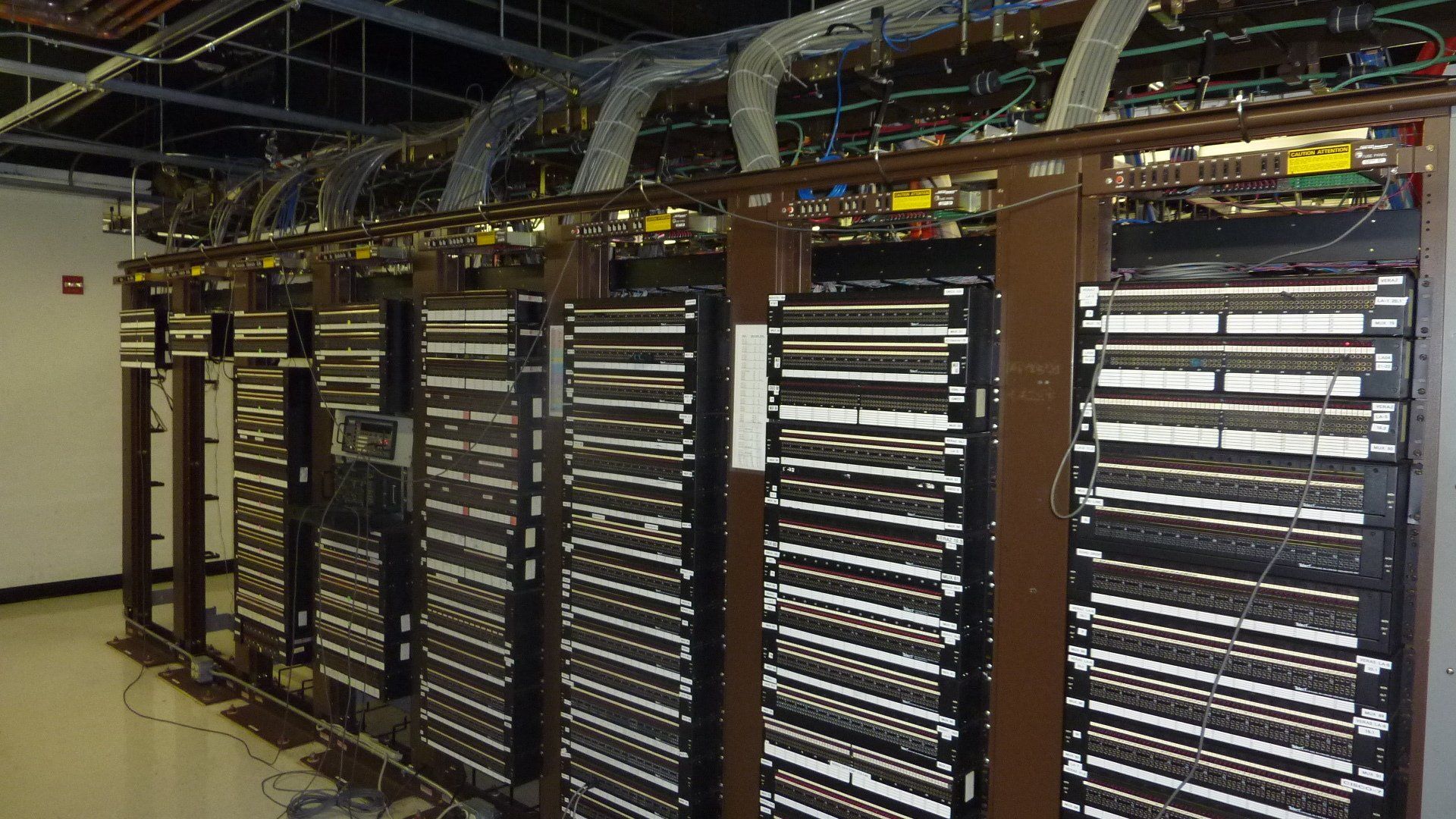

The project took place in two phases. Phase 1 was an initial visit to the two technical facilities located in New York and Los Angeles. The purpose of the visits was to determine the operational status of each of the facilities which were a mix of US central office and co-location space. The second visit (Phase 2) was to undertake full due diligence. This included detailed assessments of all the important areas such as equipment assets, liabilities, maintenance agreements, equipment warranties, utility costs, staffing levels, staffing costs, customer lists and future growth potential.

Challenge

Challenge

The project was to take place without the staff being informed of a potential acquisition. Only senior management, as well as the owner, were briefed on the project and applicable timelines. When engaging with staff and specifically when making requests for information, there was the risk that suspicions could be aroused.

The average length of service of staff was approximately 14 years. The culture of the company was very much that of a small family run business. There was a lack of documented process and procedures or a formal company organisational structure. This would make it very difficult when determining synergies between the two companies and effective integration post acquisition.

Both buildings are major data hubs and colocation centers where dozens of telecommunications companies route internet and telecom traffic. It was stated pre-project that access to sensitive areas may prove difficult. Additionally, it was made clear that meeting with the building owners was notoriously difficult at both locations. This would be necessary in order to gain a medium to long-term view of the owners plans for each location. Essential when planning for future growth.

Outcome

To keep time spent with staff down to a minimum, an electronic depository was created where requested information was posted. Full read/write access was restricted to approved personnel only. Electrical power consumption readings were taken at the mains incomers to determine total power draw at each facility. Utility bills stretching back two years and broken down per quarter, were used to determine electricity running costs. An assessment was made of available floor space and how this could be used to accommodate new racks and frames. This included re-jigging existing layouts or a complete overhaul where better. Estimated additional annual electricity costs were also included along with estimated refurbishment costs. Therefore, a return on investment figure could be calculated when the standard monthly recurring charge per amp per rack was factored in.

A full and detailed report was drafted to include the above as well as information on age of plant, maintenance schedules, equipment warranties, annual staffing costs, organizational structure, building constraints and total estimated refurbishment costs. A table was included detailing the main risks to business operation at each location along with a possible effect should each risk occur. The final section of the end project report included a high-level project plan showing the proposed timelines regarding the physical upgrade of the facilities.

The client was able to use the report and the outputs of the due diligence project to make an informed decision.